Maker

Maker

MKR is a cryptocurrency depicted as a smart contract platform and works alongside the Dai coin and aims to act as a hedge currency that provides traders with a stable alternative to the majority of coins currently available on the market. Maker offers a transparent stablecoin system that is fully inspectable on the Ethereum blockchain. Founded almost three years ago, MakerDao is lead by Rune Christensen, its CEO and founder. Maker’s MKR coin is a recent entrant to the market and is not a well known project. However, after today it will be known by many more people after blowing up 40% and it is one of the coins to rise to prominence during the recent peaks and troughs.

After being developed by the MakerDAO team, Maker Dai officially went live on December 18th, 2017. Dai is a price stable coin that is suitable for payments, savings, or collateral and provides cryptocurrency traders with increased options concerning opening and closing positions. Dai lives completely on the blockchain chain with its stability unmediated by the legal system or trusted counterparties and helps facilitate trading while staying entirely in the world of cryptocurrencies. The concept of a stablecoin is fairly straight forward – it’s a token that has its price or value pegged to a particular fiat currency. A stablecoin is a token (like Bitcoin and Ethereum) that exists on a blockchain, but unlike Bitcoin or Ethereum, Dai has no volatility.

MKR is an ERC-20 token on the Ethereum blockchain and can not be mined. It’s instead created/destroyed in response to DAI price fluctuations in order to keep it hovering around $1 USD. MKR is used to pay transaction fees on the Maker system, and it collateralizes the system. Holding MKR comes with voting rights within Maker’s continuous approval voting system. Bad governance devalues MKR tokens, so MKR holders are incentivized to vote for the good of the entire system. It’s a fully decentralized and democratic structure, then, which is an underutilized USP of blockchain tech.

Value volatility is a relative concept among both cryptos and fiat currencies. The US dollar, for example, was worth 110.748 yen on July 9, 2018. On July 4, 2011, $1 was worth 80.64 yen, and on March 18, 1985, $1 was worth 255.65 yen. These are major differences in exchange rates, and inflation within each country makes each currency worth different values even when compared to themselves. One USD in 1913 is worth the equivalent of $25.41 today, and even $1 in 1993 is worth the equivalent of $1.74 today. Stablecoins don’t negate these basic economic principles of value. Instead, both Tether and Dai have values pegged to the U.S. dollar. This is done to stabilize the price.

Cryptocoins News / The Cointelegraph - 1 year ago

According to Rep. Maxine Waters, granting crypto firms provisional registration under a proposed framework “could reward bad actors with a ‘get out of jail free’ card.”...

Cryptocoins News / The Cointelegraph - 1 year ago

A Supreme Court decision ruled that the U.S. president could not remove commissioners except for “standard of inefficiency, neglect of duty, or malfeasance.” Members o...

Bitcoin News / Bitcoinist - 1 year ago

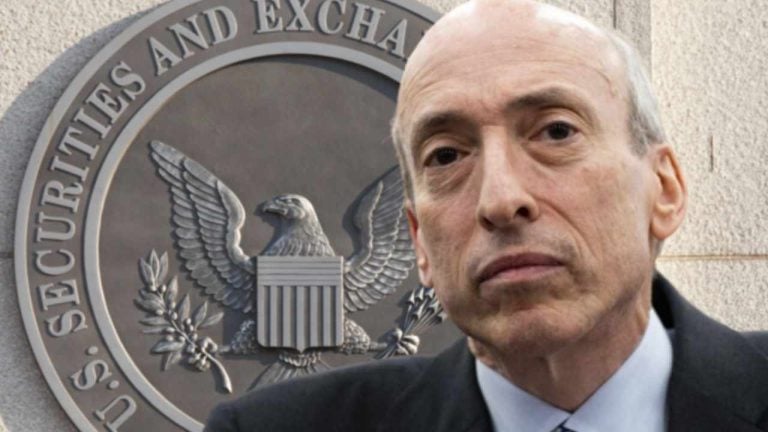

Lawmakers in the United States are taking a stand against the recent crackdown on the crypto industry by the Securities and Exchange Commission (SEC). Congressman Warren Davidson has been particularly vocal in his criticism of SEC Chairman Gary Gensl...

Cryptocoins News / The Cointelegraph - 1 year ago

“U.S. capital markets must be protected from a tyrannical Chairman, including the current one," Rep. Warren Davidson wrote in reference to SEC head Gary Gensler. Unite...

Bitcoin News / Google News Bitcoin - 1 year ago

Bitcoin, Ethereum Price To Rise Amid Positive US Fed & Inflation Data or Fall As Market Makers Exit& & CoinGape

by COINS NEWS - 1 year ago

As a follow up my post yesterday, the SEC suit against Binance comes with more news, that should be shocking, but in crypto it is only par for the course. Crypto is synonymous with yachts after all. As a small TLDR on part the other post as it...

by COINS NEWS - 1 year ago

As a follow up my post yesterday, the SEC suit against Binance comes with more news, that should be shocking, but in crypto it is only par for the course. Crypto is synonymous with yachts after all. As a small TLDR on part the other post as it...

by COINS NEWS - 1 year ago

As a follow up my post yesterday, the SEC suit against Binance comes with more news, that should be shocking, but in crypto it is only par for the course. Crypto is synonymous with yachts after all. As a small TLDR on part the other post as it...

by COINS NEWS - 1 year ago

As a follow up my post yesterday, the SEC suit against Binance comes with more news, that should be shocking, but in crypto it is only par for the course. Crypto is synonymous with yachts after all. As a small TLDR on part the other post as it...

by COINS NEWS - 1 year ago

As a follow up my post yesterday, the SEC suit against Binance comes with more news, that should be shocking, but in crypto it is only par for the course. Crypto is synonymous with yachts after all. As a small TLDR on part the other post as it...

Bitcoin News / Bitcoin.com - 1 year ago

Several lawmakers have slammed the U.S. Securities and Exchange Commission (SEC) for regulating the crypto industry by enforcement. One lawmaker says the regulator’s latest action against crypto exchange Coinbase “demonstrates a complete contempt for...

Cryptocoins News / The Cointelegraph - 1 year ago

U.S. senators asked the Justice Department to investigate whether the crypto exchange made a false statement to Congress in a letter earlier this year. Binance may hav...

Bitcoin News / Bitcoinist - 1 year ago

Two Congressmen in the United States recently blamed crypto companies as the country’s key source of tax evasion. In a letter to the Heads of the Treasury and the Internal Revenue Service, the congressmen push for tax laws specifically for the...

Cryptocoins News / The Cointelegraph - 1 year ago

In a letter addressed to Treasury Secretary Janet Yellen and IRS Commissioner Daniel Werfel, two members of Congress raised concerns about the tax compliance practices in crypto....

Bitcoin News / Bitcoinist - 1 year ago

Following the UK government’s plans to become a global hub for digital assets, lawmakers have called for comprehensive crypto regulations. The Crypto and Digital Assets APPG urged the UK government to provide clear regulatory frameworks for digital a...

Cryptocoins News / The Cointelegraph - 1 year ago

APPG chair Lisa Cameron emphasized the report’s significance in securing the U.K.’s leadership in the crypto sector and safeguarding consumers. A parliamentary group i...

Cryptocoins News / Finance Magnates - 1 year ago

A group of United Kingdom lawmakers has recommended that the government expedite the introduction of crypto regulations. The All Party Parliamentary Group (APPG) for Crypto and Digital Assets Group wants the appointment of a dedicated official to ove...

Cryptocoins News / The Cointelegraph - 1 year ago

The framework under the bill would allow certain tokens to qualify as digital commodities if they were decentralized and crack down on the SEC’s previous approach to crypto....

Cryptocoins News / EthereumWorldNews - 1 year ago

U.S. lawmakers Rep. Patrick McHenry and Rep. Glenn Thompson have introduced a new bill calling for clear crypto regulations.& The proposed legislation would protect crypto assets from enforcement actions until regulators set up new rules for the...

Cryptocoins News / EthereumWorldNews - 1 year ago

The MakerDAO community has voted in favor of a proposal to purchase $1.28 billion worth of U.S. Treasuries.& The proposal, dubbed Project Andromeda, was put forward by crypto investment firm Blocktower Capital.Maker is set to exchange 1.28 billi...

Cryptocoins News / CoinJournal - 1 year ago

The MakerDAO community has voted to ditch Pax Dollar (USDP) stablecoin worth $500 million from its reserves.

Maker’s treasury holds roughly half of the USDP’s $1 billion supply.

New York state regulators in February forced Paxos to halt...