Key Takeaways:

- By joining the S&P 500, Coinbase becomes the first cryptocurrency company to do so, hence signifying a significant turning point in crypto’s incorporation into conventional finance.

- The addition comes after Coinbase’s robust financial results and market value exceeding $53 billion.

- This action supports crypto’s validity on Wall Street by reflecting accelerating institutional adoption of digital assets.

More than a symbolic win, Coinbase‘s inclusion in the S&P 500 marks a seismic change in the way the financial sector sees cryptocurrency. This moment confirms crypto’s entry in the economic mainstream as institutional barricades fall and acceptance rises.

Read More: Coinbase Review 2025: Is This Centralized Exchange Legit and Safe for Beginners?

Coinbase Enters Wall Street’s Premier Club

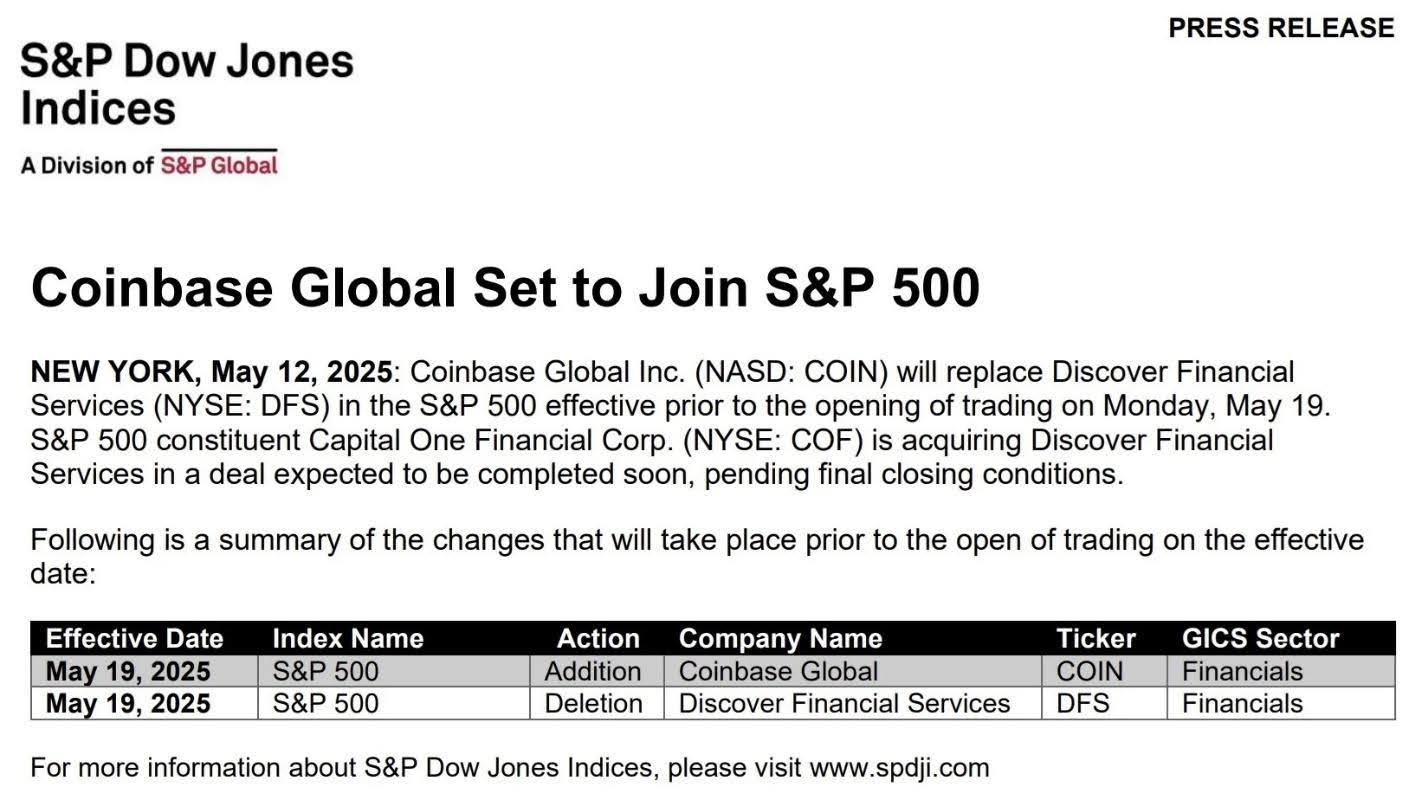

With Capital One’s acquisition of Discover Financial Services (NYSE: DFS), Coinbase Global Inc. (NASDAQ: COIN) will supplant it in the S&P 500 on May 19, 2025. When it comes to bitcoin companies, Coinbase is the only one on the S&P 500 right now. The S&P 500 is a ranking of the 500 biggest publicly traded companies in the US.

S&P Dow Jones Indices guaranteed the businesses qualified by verifying they fulfilled rigorous standards. Companies had to have a market value of at least $18 billion, be very liquid, make most of their shares available to the public, and show that they were profitable over the last four quarters. With a market value of more than $53 billion and a solid Q4 2024 performance with income over $6.6 billion, Coinbase qualifies for all these criteria.

Coinbase’s CEO Brian Armstrong wrote on X:

“Coinbase just became the first and only crypto company to join the S&P 500. This milestone represents what the true believers knew all along. Crypto is here to stay.”

Coinbase just became the first and only crypto company to join the S&P 500.

This milestone represents what the true believers, from retail investors to institutional investors to our employees and partners, knew all along.

Crypto is here to stay. https://t.co/MnMRCX8pMg

— Brian Armstrong (@brian_armstrong) May 12, 2025

Read More: Trump’s Pro-Crypto Stance: Coinbase to Create 1,000 US Jobs

Institutional Signal: Crypto Goes Mainstream

Index Inclusion Triggers Massive Investment Flows

Coinbase’s inclusion in the S&P 500 has significant financial effects, not only a badge of pride. Funds tracking the S&P 500, including pensions, mutual funds, and ETFs, manage about $15.6 trillion in assets. These funds will be obligated to buy COIN stock once Coinbase is formally included, hence raising demand and maybe causing major price movement.

Moreover, index inclusion enhances credibility. For years, crypto critics have ridiculed the sector as speculative or volatile. With Coinbase now joining one of the most well-known financial indices in the world, the message is obvious: crypto has earned its place at the table.

This could have ripple effects beyond just Coinbase stock. Exposure to crypto infrastructure through S&P 500 portfolios means more retail and institutional investors will indirectly hold crypto assets. It’s a step toward normalizing digital assets in traditional portfolios and retirement accounts.

Crypto Exchange Sector in Rapid Growth Mode

Coinbase’s growth mirrors the more general movement in the crypto exchange sector. Projected to be $71.94 billion by 2029 and $213.15 billion by 2034, the worldwide crypto exchange industry, valued at $24.75 billion in 2024, according to market predictions. Being one of the biggest exchanges worldwide, Coinbase is perfectly placed to seize a significant portion of this expansion.

With non-U.S. income making 19% of Q4 profits, Coinbase has also advanced abroad, indicating strong expansion and usage beyond the American market.

In recent years, the company’s business model has changed. While trading still contributes significantly, subscription and services revenue has grown rapidly, creating a more stable income stream. With increasing adoption of stablecoins and layer-2 networks, Coinbase is aligning itself with emerging financial infrastructure trends.

A Milestone for the Entire Crypto Industry

Coinbase’s inclusion isn’t just about one company—it’s about the validation of an entire industry. As the first crypto-native firm to be recognized at this level, the moment holds weight similar to what Tesla’s S&P 500 inclusion meant for electric vehicles.

Michael Saylor, Executive Chairman of MicroStrategy (NASDAQ: MSTR), congratulated Coinbase on X, calling the milestone a “major moment for Coinbase and for Bitcoin.”

This recognition also follows several other major crypto milestones:

- Approval of spot Bitcoin ETFs in early 2024

- USDC and Bitcoin reaching all-time highs

- A shift in U.S. federal policy in favor of crypto innovation

All signs point toward a broader institutional pivot. Coinbase’s listing now brings crypto one step closer to full integration into the traditional financial system.

Crypto’s Next Frontier: From Speculative to Systemic

Getting here was not easy. For more than ten years, crypto businesses have battled public doubt, volatility, and regulatory ambiguity. Though coping with regulatory issues and market declines, Coinbase has managed to negotiate those difficulties and remain profitable.

Its rise to the S&P 500 reflects a change from outsider to systematic player. It’s a sign that crypto businesses are now part of the economic infrastructure rather than specialized tech enterprises.

This addition might also hasten the trend of conventional companies including blockchain into their operations or adding cryptocurrency to their balance sheets. The change from “crypto as hype” to “crypto as core finance” is no longer speculative; it is in motion.

Coinbase’s ascent into the S&P 500 is not only another corporate news. One that opens the doors for more institutional involvement and future listings of other crypto-native companies, it’s a turning point in crypto’s path toward mainstream awareness. The next chapter of digital finance is no longer ahead—it’s already unfolding.

The post Coinbase Breaks Barriers: First-Ever Crypto Company Added to the S&P 500 Index appeared first on CryptoNinjas.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments