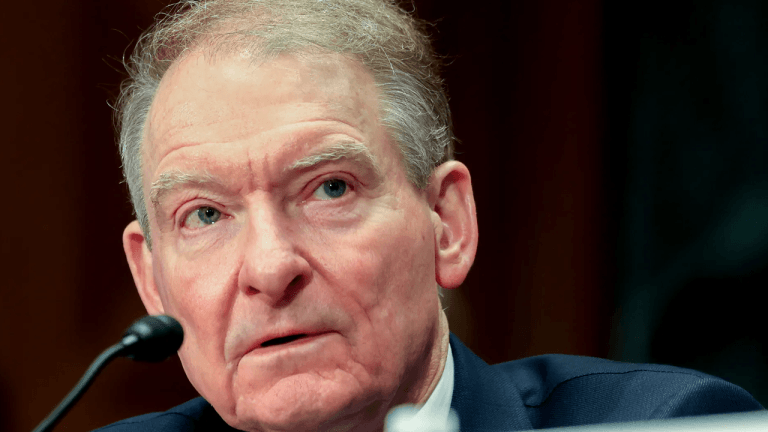

MAGA Inc., the flagship super PAC backing US President Donald Trump, has amassed a staggering $200 million in donations, with a substantial portion coming from the crypto industry. High-profile figures like Elon Musk and the Winklevoss twins have contributed millions, underscoring the growing alignment between industry power players and Trump’s political machine. As the 2026 midterm elections approach, MAGA Inc. holds an unprecedented war chest, positioning itself as a dominant force in upcoming political battles.

However, there’s growing skepticism within the crypto community about whether these funds will actually benefit pro-crypto candidates in the midterms. MAGA Inc.’s previous iteration was known for holding back significant resources during the midterm cycles, choosing instead to focus on a major push for the 2024 presidential election. This strategy raises questions about the super PAC’s intentions and whether the industry’s financial support will translate into meaningful legislative advocacy.

With regulatory clarity and friendly policies high on the industry’s priority list, many are watching closely to see if MAGA Inc.’s financial muscle will align with pro-innovation agendas in Washington. For now, the donations signal strong political engagement from crypto giants, but the real impact remains uncertain.

Crypto Industry Aligns With Trump’s Vision For US Crypto Dominance

Several major crypto firms have emerged as key contributors to MAGA Inc., signaling a deepening alliance between the President and the digital asset industry. Companies like BTC Inc, BitGo Inc, and Gemini Trust Company—the latter owned by the Winklevoss twins—have all made substantial donations to the super PAC, further solidifying Trump’s position as a pro-crypto President.

Trump has been increasingly vocal about his support for cryptocurrencies, positioning himself as a defender of innovation against what he perceives as overregulation from federal agencies. His statements about making the United States the “Crypto Capital of the World” have resonated within the industry, which continues to seek clearer regulatory frameworks and support for blockchain technology.

These high-profile donations are more than just financial gestures—they represent a coordinated effort by the crypto sector to align with policymakers who are willing to advocate for the industry’s growth. As regulatory clarity becomes a pressing issue, especially concerning token classification, stablecoins, and DeFi platforms, Trump’s stance is seen as a potential catalyst for positive legislative action.

The coming months will be pivotal. With regulatory uncertainty still clouding the US market, the crypto industry is betting that Trump’s political capital and the war chest of $200 million will translate into policy influence. While it remains to be seen how effectively these funds will be used to advance pro-crypto agendas, the donations from BTC Inc, BitGo, and Gemini mark a significant moment of political engagement, one that could shape the trajectory of crypto adoption and innovation in the US for years to come.

Total Crypto Market Cap Analysis

The total crypto market cap has recently faced a sharp correction after a strong bullish rally, dropping by 6.27% to $3.65 trillion. This pullback comes after the market briefly touched $3.93 trillion, a level close to previous highs set in late 2021. The chart shows that despite the recent decline, the market structure remains bullish, with higher highs and higher lows since the rebound from the $2.4 trillion region in April.

The 50-week moving average continues to trend upward, providing dynamic support around the $2.95 trillion level, while the 100-week and 200-week moving averages remain below at $2.41 trillion and $1.88 trillion, respectively. This alignment of moving averages confirms a long-term uptrend.

Related Reading: Ethereum Chain Dominates RWA Market With 83.69% Share

However, the market now faces a key test. Bulls must hold the $3.6 trillion support to prevent a deeper retracement towards the $3.2 trillion level. A failure to maintain this support could trigger a larger correction, while a successful defense may open the path for another push toward the elusive $4 trillion psychological barrier.

Featured image from Dall-E, chart from TradingView

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments