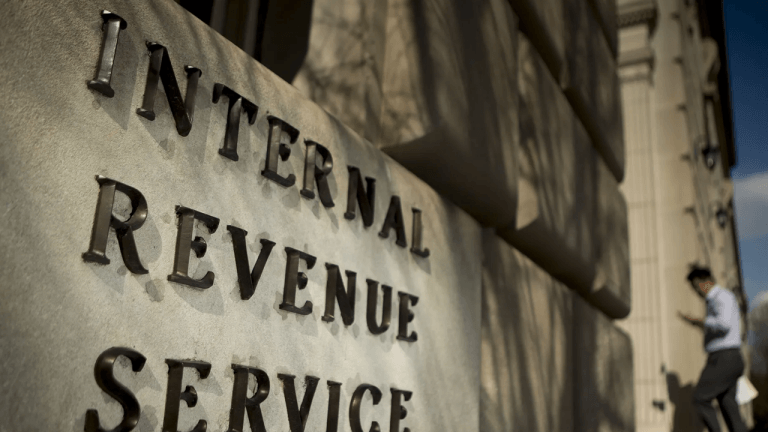

The Internal Revenue Service’s new Form 1099-DA, while designed to streamline tax reporting for cryptocurrency users, may inadvertently trigger audits due to incomplete cost basis data provided by exchanges, an expert warns. The ‘Phantom Gain’ Trap The Internal Revenue Service (IRS)’s new Form 1099-DA, though well-intentioned, could unfairly target many cryptocurrency users for audits due […]

The Internal Revenue Service’s new Form 1099-DA, while designed to streamline tax reporting for cryptocurrency users, may inadvertently trigger audits due to incomplete cost basis data provided by exchanges, an expert warns. The ‘Phantom Gain’ Trap The Internal Revenue Service (IRS)’s new Form 1099-DA, though well-intentioned, could unfairly target many cryptocurrency users for audits due […]

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments