Key Takeaways:

- o1.exchange raised $4.2 million in a funding round led by Coinbase Ventures and AllianceDAO.

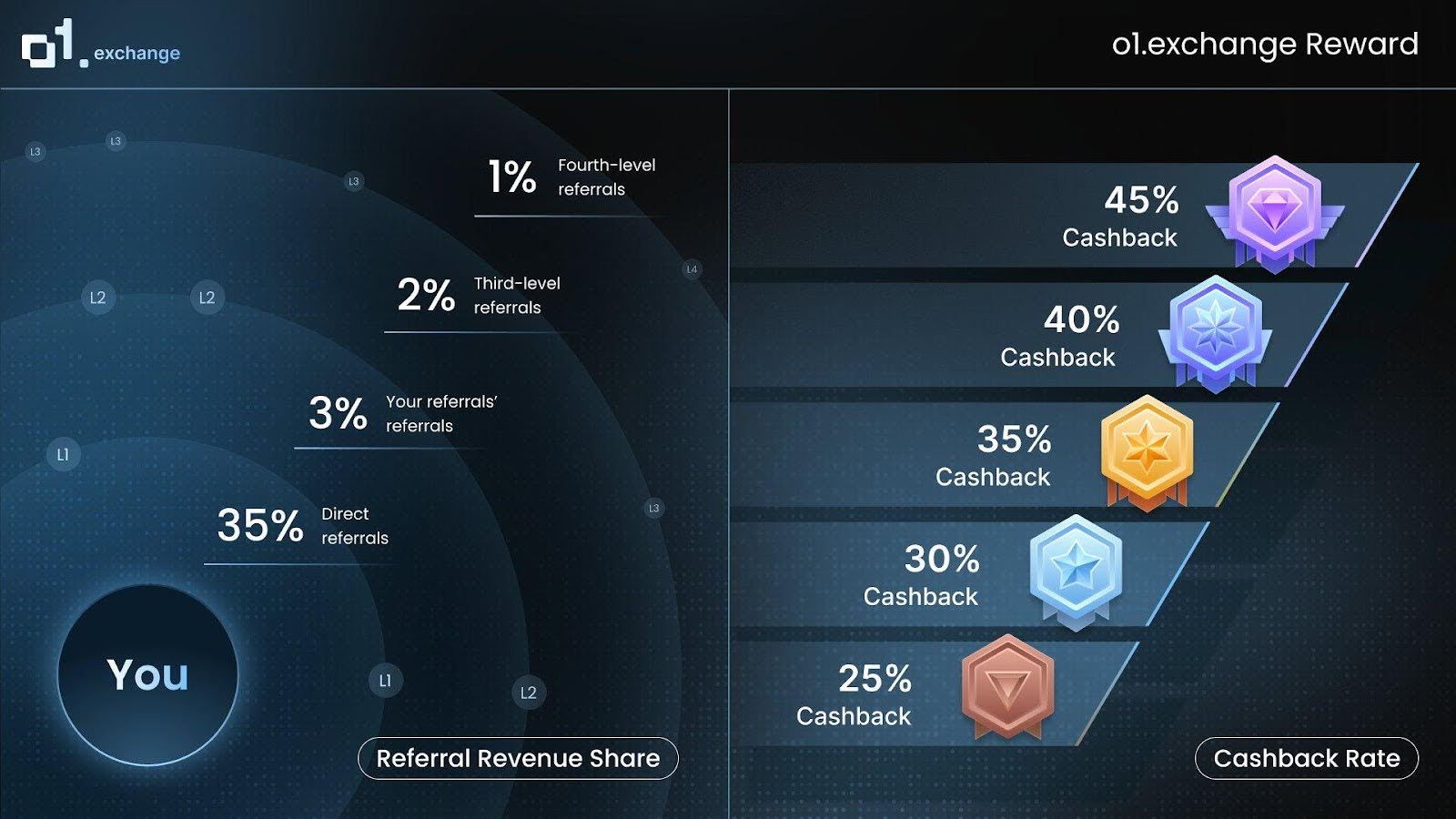

- The platform introduces a 45% cashback program and 41% referral revenue share to boost user adoption.

- Features include on-chain trading terminal, TradingView enterprise charts, multi-wallet management, and fastest trade execution at ≤1 block.

The Base ecosystem just got a major push. o1.exchange, which calls itself the first full-scale trading terminal built on Base, has announced a $4.2 million funding round alongside the rollout of an aggressive cashback and referral rewards program. Backed by Coinbase Ventures and AllianceDAO, the platform aims to set a new benchmark for decentralized trading infrastructure.

Funding Round: A Strategic Boost for Base

The increase in funds to $4.2 million places o1.exchange as one of the best-funded projects in the Base ecology. The fact that the parent ecosystem Base will be directly involved in the success and credibility of the project arouses the willingness of Coinbase Ventures to lead the round. The backing also has a strategic depth as AllianceDAO is also an incubator that works with high-potential crypto startups.

This new round of funding will be utilized to speed the pace of building utility around o1.exchange trading platform, deepen into integration with leading protocols and launch reward systems to target both retail traders and professional market players.

The investment is also an indication of the emerging desire of venture firms to invest in infrastructure level projects within Base, particularly those that have the potential to open up liquidity, transparency, and efficiency in execution.

Key Features of the o1.exchange Trading Terminal

Advanced On-Chain Capabilities

o1.exchange is positioning itself as the “Bloomberg Terminal for Base,” offering a suite of tools rarely seen in decentralized environments. These include:

- On-chain data analytics: Aggregated DEX data and wallet tracking in real time.

- TradingView Enterprise Charts: Traders can expand candlestick data to review detailed trade flows within specific timeframes.

- Advanced order types: Limit orders, sniping, and TWAP (Time-Weighted Average Price) execution strategies.

- Execution speed: Trades settle in one block or less, minimizing slippage.

This focus on execution speed is particularly notable. In decentralized markets, transaction delays can erode profitability. By promising ≤1 block execution, o1.exchange is competing not just with DEX interfaces but even with some centralized exchanges in terms of responsiveness.

Wallet and Multi-Chain Support

The multi-wallet management is possible in the platform and features a self-custodial wallet that provides ease of use along with security as well. It has inbuilt cross-chain support and bridging functionalities which allows cross-chain mobility of assets.

The compatibility with almost all the Base launchpad projects such as Zora, BaseApp, Virtuals, and ClankerOnBase has another synergy layer on the ecosystem. Liquidity access and sophisticated order capabilities are also aggressively enabled through partnerships with Uniswap V4.

Read More: Base Network Outage Raises Red Flags Over Centralized Sequencer Design

Incentive Programs: Cashback and Referrals

The most impressive announcement besides the news about the funding is that it has launched an ambitious cashback and referral program:

- 45% cashback rate: Traders get back almost 50% of the trade fees charged, a level much higher than most of their centralized or decentralized competitors can afford to pay.

- 41% referral revenue share: First movers and customers can earn money out of their networks and this can lead to viral growth.

This type of aggressive incentive is meant to bring on board users at a fast pace within a flooded DeFi market. With competition from platforms on Ethereum, Solana, and other L2 networks, o1.exchange appears to be betting on rewards to capture trader loyalty.

Competitive Landscape: Why This Matters

Whereas the meme tokens and NFT in Base have exploded, the trading infrastructure on the network is still relatively underdeveloped. Instant access to a wide variety of tools is a priority of most traders who still use traditional DEX interfaces.

By establishing an integrated end to end terminal with enterprise level capabilities, o1.exchange is standing out among other Base projects. Its tactics resemble a similar situation of Binance or FTX in the initial stages of its development using sophisticated trading features and rewards to get ahead of the competition.

Provided it works, o1.exchange can be become the hub where serious traders on Base will trade, thus generating liquidity and making the market deeper and more mature.

Layer-2 networks such as Base, Arbitrum, and Optimism are catching the eye of more institutional players. These ecosystems are appealing in their scaled down, interoperable, scalable nature and to high-frequency trading and structured financial products.

Read More: JPMorgan Unleashes JPMD on Base: The $4T Banking Giant’s Bold Leap into Public Crypto Rails

The post o1.exchange Secures $4.2M to Build the First Full Trading Terminal on Base appeared first on CryptoNinjas.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments