Key Takeaways:

- SEC Chairman Paul Atkins calls tokenization a legitimate market innovation, not a regulatory loophole.

- The SEC aims to support new technologies while reinforcing investor protection in crypto and private markets.

- Discussions around expanding access to private assets raise questions about accredited investor rules.

SEC Chairman Paul Atkins made headlines during a recent appearance on CNBC’s Squawk Box, where he addressed the evolving role of the agency in overseeing crypto innovation, particularly tokenization — a hot topic across public and private financial sectors. He acknowledged that while the regulatory environment has been criticized for stifling progress, the SEC is now shifting its approach to provide clearer guidance and support technological advancements without compromising investor safeguards.

Read More: Paul Atkins Officially Confirmed as New SEC Chairman in Time of Regulatory Crossroads

Tokenization Gains Regulatory Recognition

The U.S. Securities and Exchange Commission (SEC) has often taken a cautious stance toward crypto. However, Paul Atkins’ recent remarks mark a notable shift in tone. Speaking directly on CNBC, Atkins emphasized that “tokenization is an innovation”, dismissing the notion that it is merely a loophole to circumvent securities laws.

This comment comes at a time when numerous financial institutions are experimenting with blockchain technology to tokenize traditional assets — such as private company shares, credit, or real estate. The goal is to unlock greater efficiency, 24/7 settlement, and broader access to investment products.

Atkins made it clear: “The SEC should focus on how we advance innovation in the marketplace.” He pointed to past agency behavior as overly dependent on enforcement rather than proactive rulemaking, acknowledging that this has often created uncertainty for builders in the crypto space.

A New Direction for Crypto Oversight

Moving Beyond Regulation by Enforcement

The Chairman’s remarks signal a clear intent to replace the “regulation by enforcement” model with more transparent frameworks. Atkins stated that innovation has often been held back by unclear regulations, but those days are coming to an end.

He suggested that by providing definitive rules and eliminating ambiguity, the SEC can encourage responsible development of blockchain-based financial technologies.

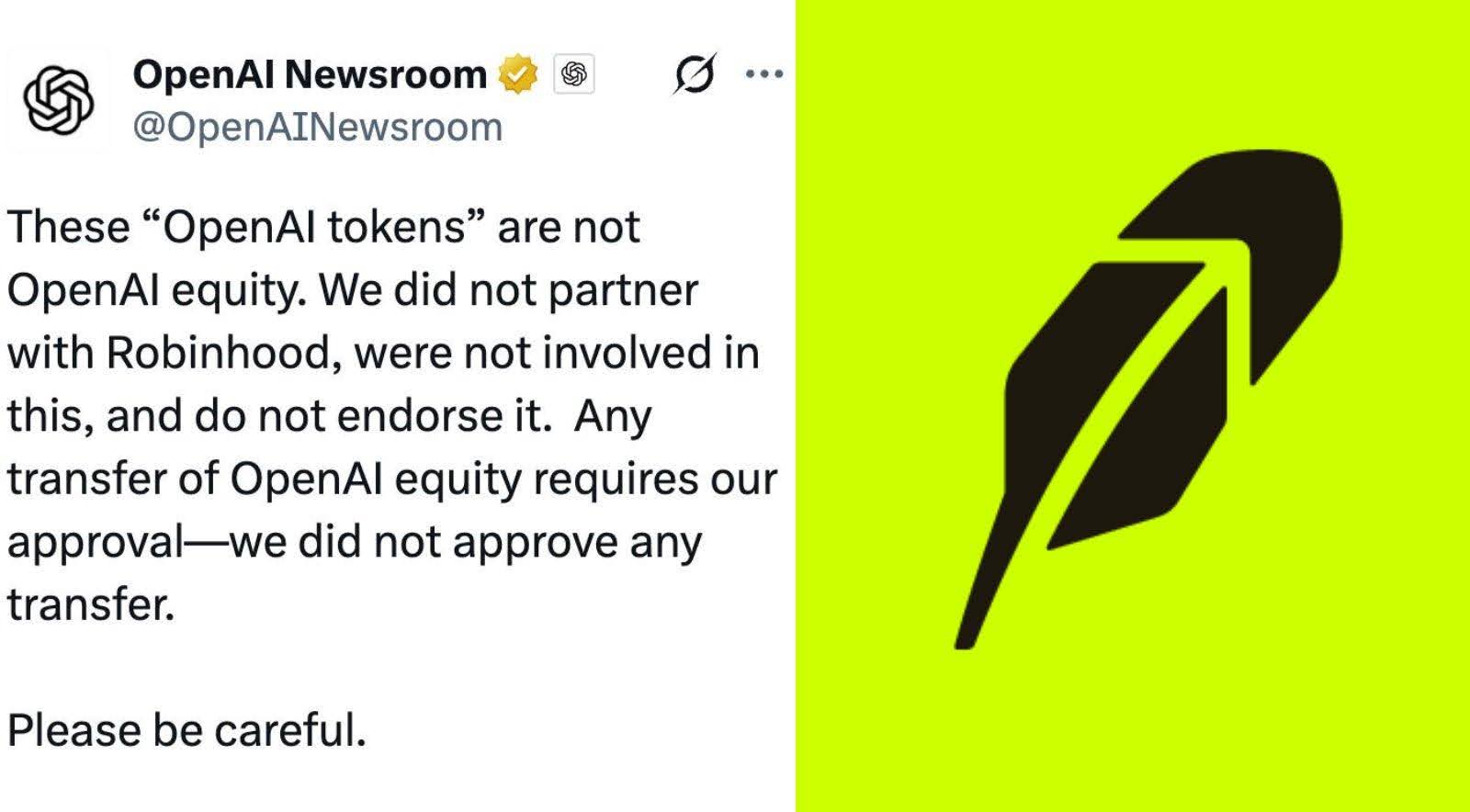

This could have wide-reaching implications for companies in the tokenization space. Several U.S. and international platforms, including Robinhood and Swarm Markets, have begun offering tokenized versions of private equities or pre-IPO shares — including assets like SpaceX stock — to investors in regulated jurisdictions outside the U.S.

These developments have raised questions about jurisdiction, investor access, and whether such offerings comply with U.S. securities laws, especially when marketed globally. Atkins’ public embrace of tokenization suggests that the SEC might soon offer a more structured regulatory framework to address these questions head-on.

Retail Access to Private Markets Under Review

While welcoming innovation, Atkins also cautioned against rushing retail investors into illiquid or risky asset classes, especially in the form of tokenized private credit or equity products.

Currently, only “accredited investors” — those with a net worth exceeding $1 million or meeting high income thresholds — are permitted to access private placements and venture opportunities. Yet, the wall is being heavily criticized for all the people it leaves out of high-growth asset classes.

Atkins said that the push to revisit the definition of an accredited investor could eventually mean, not just wealth, but an actual basis of financial literacy and understanding might qualify a person. He floated the notion of educational requirements, saying that “there are lots of different ways” for measuring readiness to make private investments beyond net worth.

Still, he also stressed the importance of guardrails and transparency, saying it was difficult to value even accurately the private assets on which the loans were secured. “Liquidity is not what it is in public markets. Valuations are tricky,” he said, suggesting that if tokenization accomplishes anything, it’s just shifting those risk valuations around.

Innovation with Guardrails: Balancing Progress and Protection

Atkins said the SEC continues to be driven by its fundamental elements: protecting investors, encouraging capital formation, and maintaining fair and orderly markets. Accelerating blockchain innovation, these goals hold, the methods by which they are reached are changing.

Notably, he emphasized that tokenization should be used more to enhance market infrastructure — in areas such as settlement speed, security and cost efficiency improvements — rather than to directly port over risky products into digital form.

He highlighted the shift to T+1 settlement in U.S. equities as a major modernization step, and said tokenization could drive even greater improvements in how trades are finalized and assets are held — potentially offering real-time settlement and global interoperability.

SEC Faces Pressure to Modernize

In a wider picture of what Atkins has to say, there has been an increased pressure on the SEC to revise its rules in response to the disruption caused by technology. As Europe adopts the MiCA regulatory framework, and jurisdictions such as Singapore and the UAE advance regulations on crypto, the U.S. leaves itself behind.

Read More: Hong Kong Unveils Bold Crypto Policy: Stablecoin Licensing and Tokenized Bonds Incoming

SEC has been accused by industry leaders in giving vague enforcement action instead of clear policy statements. The decision to move the agency towards friendly oversight where clarity and innovation could be found was met positively in the crypto industry by the commitment of Atkins to handover.

However, the test lies ahead — in how the SEC translates these words into practical rules, sandbox environments, or pilot programs for tokenized assets and other crypto-native innovations.

The post SEC Chairman Declares Tokenization as Innovation Amid Crypto Rule Reevaluation appeared first on CryptoNinjas.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments