Nasdaq-listed SharpLink Gaming has expanded its Ethereum holdings through a direct over-the-counter transaction with the Ethereum Foundation. The company purchased 10,000 ETH for approximately $25.7 million, pricing each token at $2,572.37.

The deal, finalized on July 10, increases SharpLink’s total ETH balance to 215,634 tokens, according to data from DeFiLlama. At current market value, that brings the firm’s treasury to an estimated $558 million, positioning it as one of the largest known institutional holders of ETH.

The move reflects a deepening strategy from SharpLink, which has steadily shifted its balance sheet toward Ethereum since early June. According to the company, the ETH accumulation is not just a corporate treasury play, but a broader alignment with the ETH ecosystem.

Funds for the acquisition reportedly came from at-the-market share sales, part of a $425 million private raise led by Consensys, the blockchain software company founded by SharpLink Chairman and Ethereum co-founder Joseph Lubin.

Strategic ETH Acquisition Aims to Support DeFi Infrastructure

SharpLink emphasized that the purchase is not only about balance sheet expansion but also a commitment to long-term support for Ethereum’s decentralization. In the statement, Lubin noted that the company is actively staking and restaking ETH in an effort to reduce circulating supply and contribute to the network’s health.

“SharpLink is acquiring, staking, and restaking ETH as responsible industry stewards, removing supply from circulation and reinforcing the health of the Ethereum ecosystem,” he said. The transaction marks a rare instance of the Ethereum Foundation transferring such a large volume of ETH directly to a public company.

While the foundation has made ETH sales in the past, often viewed as macro sentiment indicators, this direct transfer to a corporate buyer is unusual and may signal evolving relationships between crypto-native institutions and traditional capital markets.

The ETH Foundation, based in Zug, Switzerland, plays a central role in supporting the development and research behind ETH’s protocol. Its ETH reserves are typically used to fund research grants, developer bounties, and infrastructure projects.

The sale to SharpLink suggests that it is also exploring strategic partnerships to deepen Ethereum’s integration into regulated financial ecosystems.

Corporate Crypto Allocation Trends Continue to Shift

SharpLink’s ETH-heavy treasury strategy follows a broader pattern of increasing institutional interest in digital assets beyond Bitcoin. While MicroStrategy’s Bitcoin-focused balance sheet has dominated headlines, SharpLink’s growing Ethereum position illustrates expanding diversification among public firms in the crypto space.

As more institutions evaluate on-chain assets not just for speculation but as foundational infrastructure, Ethereum appears to be gaining traction.

The firm’s activity may also reflect broader investor behavior amid ETH’s growing role in DeFi. With staking yields, Layer 2 adoption, and real-world asset tokenization narratives on the rise, ETH’s appeal to corporations seeking exposure to blockchain-based finance continues to evolve.

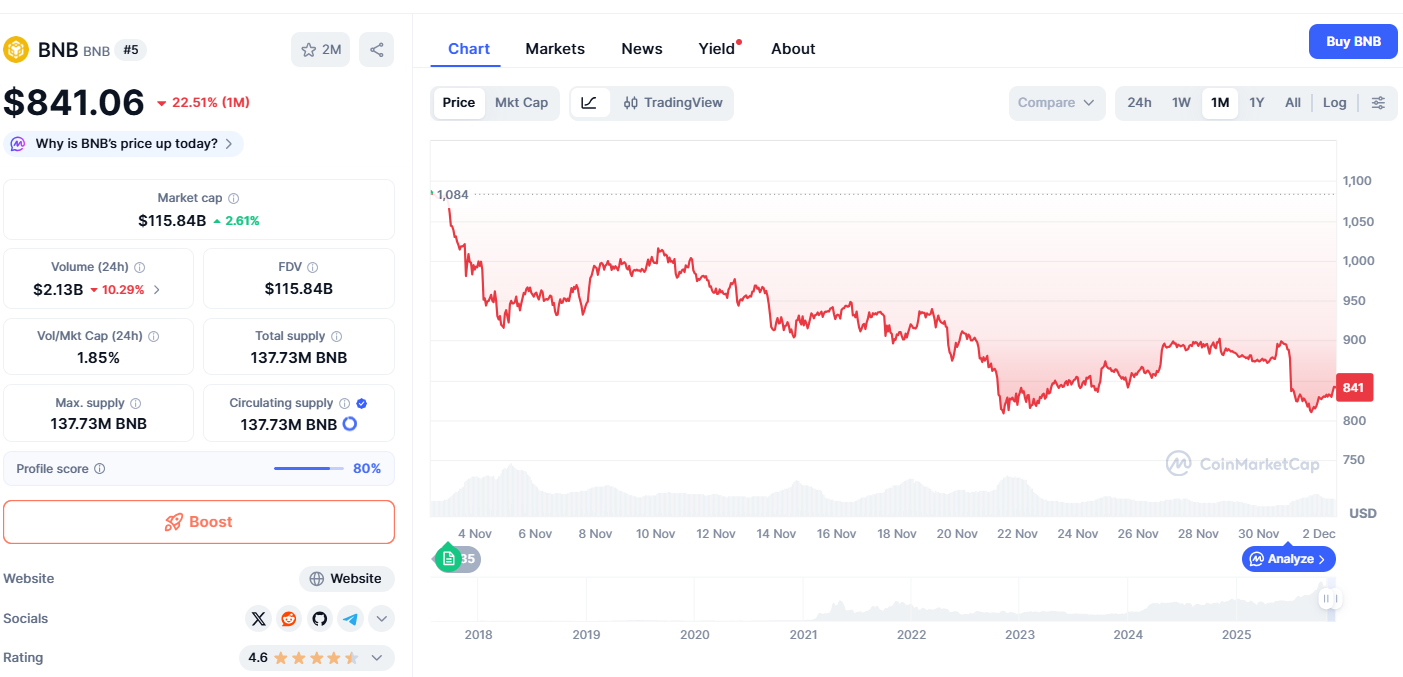

Featured image created with DALL-E, Chart from TradingView

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments