Stablecoins might sound like something you’d use to bribe a medieval horse, but in reality, they’re the no-drama cousin of regular cryptocurrencies. Tied to the value of fiat currencies like the U.S. dollar, they bring the innovation of crypto without the wild price swings that make your dad swear off “those fake internet coins” forever.

And guess what? Gen Z and Millennials are essentially in a committed relationship, not just flirting. In the meantime, older generations continue to hover at the door, peering in as though they’re not sure how to dress for this strange new club. Our research, which surveyed 510 participants, reveals who’s adopting stablecoins, why, and what’s holding back broader usage.

Key Findings

- 53% of respondents have already used stablecoins

- The 2 most common motivations of stablecoin users are yield edge (37%) & inflation hedge (~30%)

- 59% of respondents are willing to receive their salary in stablecoins.

Methodology

This article is built upon a survey conducted with 510 participants on Prolific, aiming to capture diverse perspectives across multiple generations regarding stablecoin awareness, adoption, and usage behaviors.

Stablecoins Aren’t Niche Anymore They’re Practically Mainstream

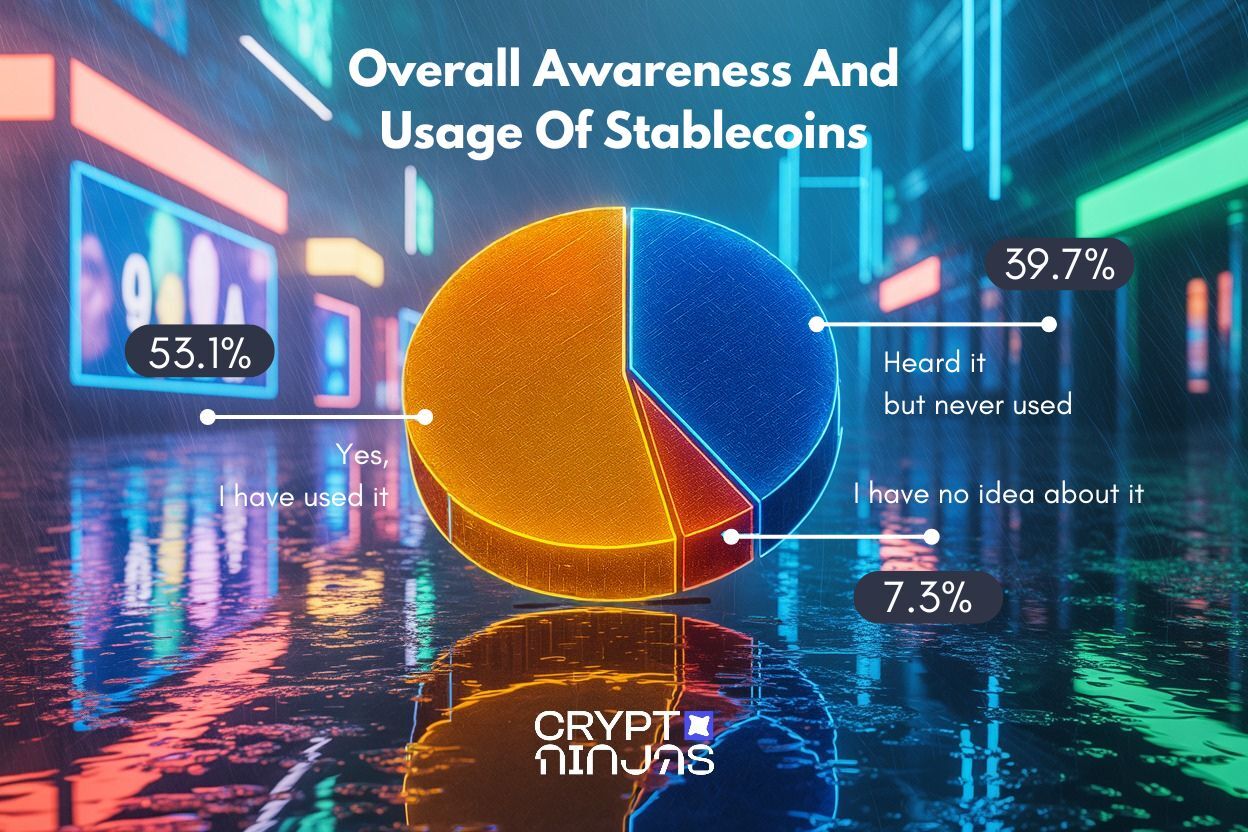

Let’s get this out of the way: stablecoins aren’t niche anymore. According to a recent survey:

- 53% of people have already used stablecoins

- 39% know about them but haven’t tried them yet

- Only 7% are still in the dark

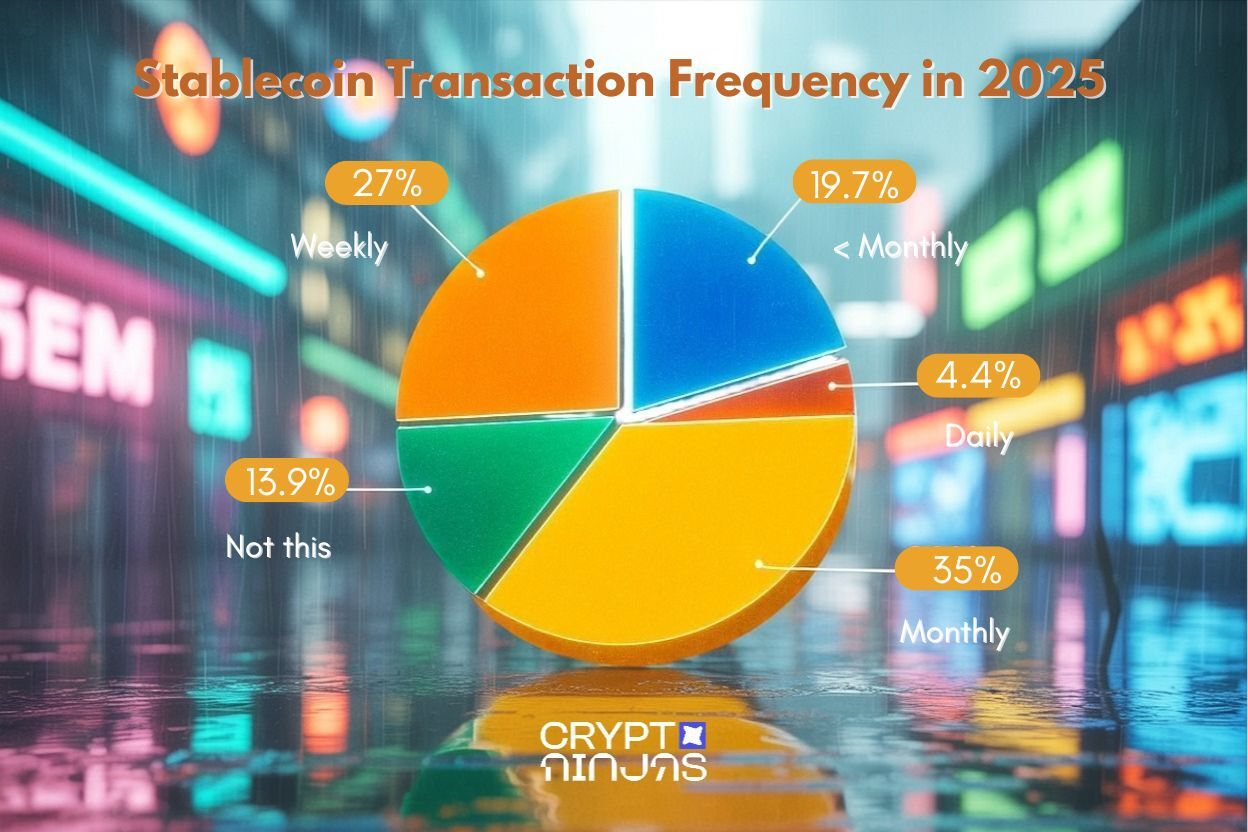

Even better, 34% of users are making stablecoin transactions monthly. That’s not just dabbling that’s commitment. It shows people are starting to see these coins as actual financial tools, not just something you mess around with after watching too much YouTube crypto content.

Gen Z = The Main Characters in the Stablecoin Story

So who’s using stablecoins the most? Surprise, it’s not your Uncle Bob who just got into crypto last year and won’t stop talking about “the blockchain.”

It’s Gen Z those who practically grew up online. They’re not just using stablecoins they’re living in them.

- 46% of Gen Z stablecoin users transact monthly

- Compare that with 30% of Millennials and 29% of Gen X

- They’re already deep in the DeFi rabbit hole, comfy on platforms like Reddit, Discord, and X.

For 46% of Gen-Z, the big draw is yield farming basically, earning passive income from crypto platforms. Speed, inflation protection, and easy access to crypto round out their list of reasons to use stablecoins.

For 46% of Gen-Z, the big draw is yield farming basically, earning passive income from crypto platforms. Speed, inflation protection, and easy access to crypto round out their list of reasons to use stablecoins.

Millennials and Gen X: Still Interested, Still Cautious

Millennials? They’re dealing with real-world stuff like rent hikes and economic uncertainty. No surprise, 33% of them see stablecoins as a way to hedge against inflation, with 30% chasing that sweet DeFi yield.

Gen X takes the cake for “most balanced.” They are curiously but cautiously investigating stablecoins, balancing their use between easing into other crypto assets and protecting against inflation.

They are essentially the buddy who arrives at the party, observes the situation, and chooses to remain for a drink. Reasonable.

Salary in Stablecoins? Gen Z Says, “Heck Yes.”

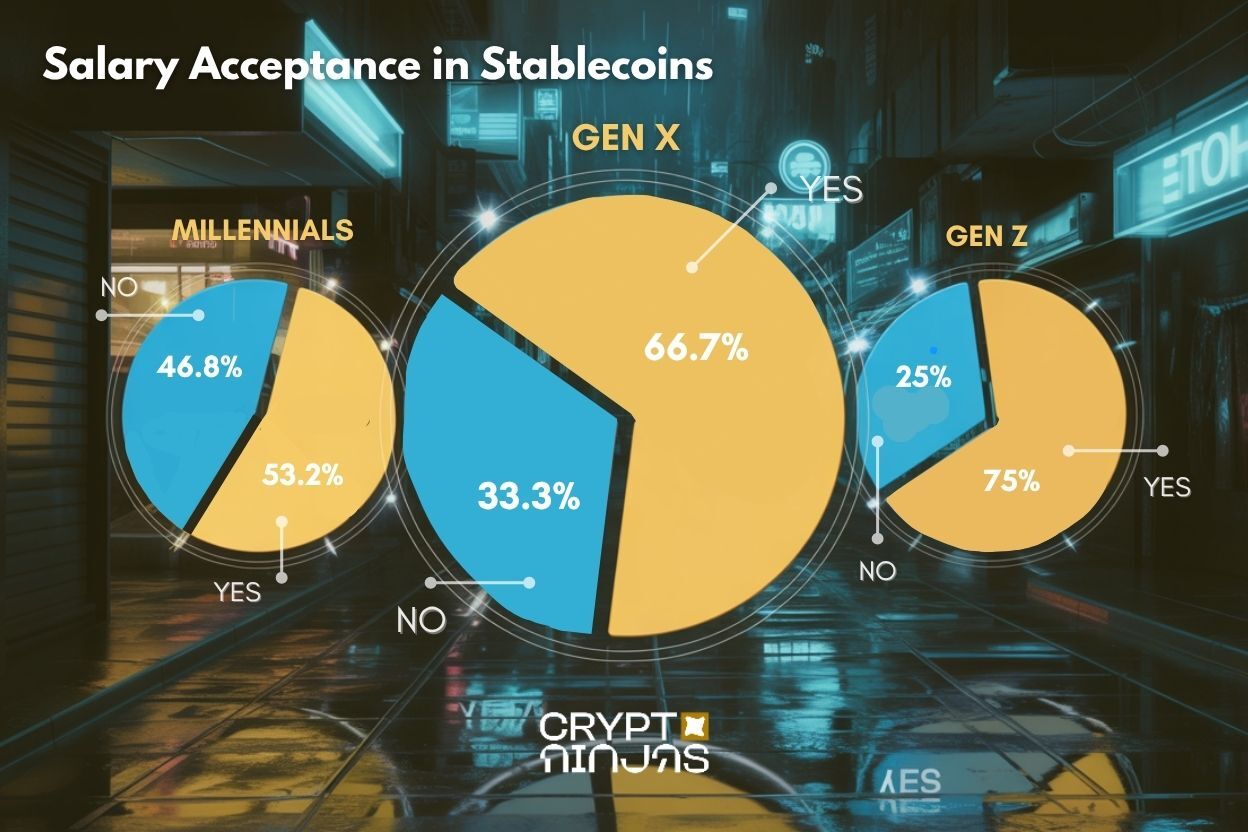

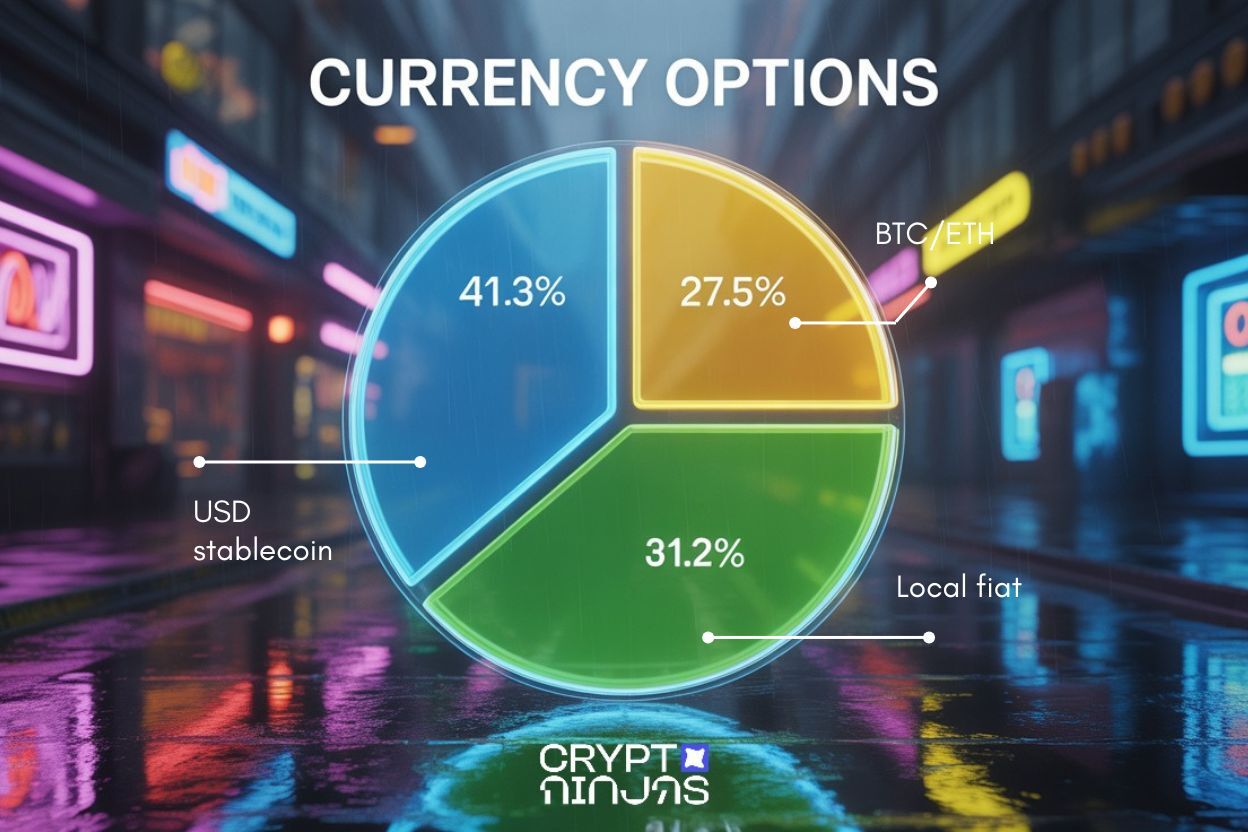

One of the more unexpected stats? 57% of stablecoin users would be totally down to get their paycheck in stablecoins. Among Gen Z, that jumps to a whopping 75%.

Most of them prefer good ol’ USD-backed coins because being bold doesn’t mean being reckless. Even Gen X seems open to the idea, with 66% saying they’d consider it. Millennials, surprisingly, are the most hesitant at 53%.

Maybe they’ve just seen one too many crypto price dips while trying to pay off their student loans.

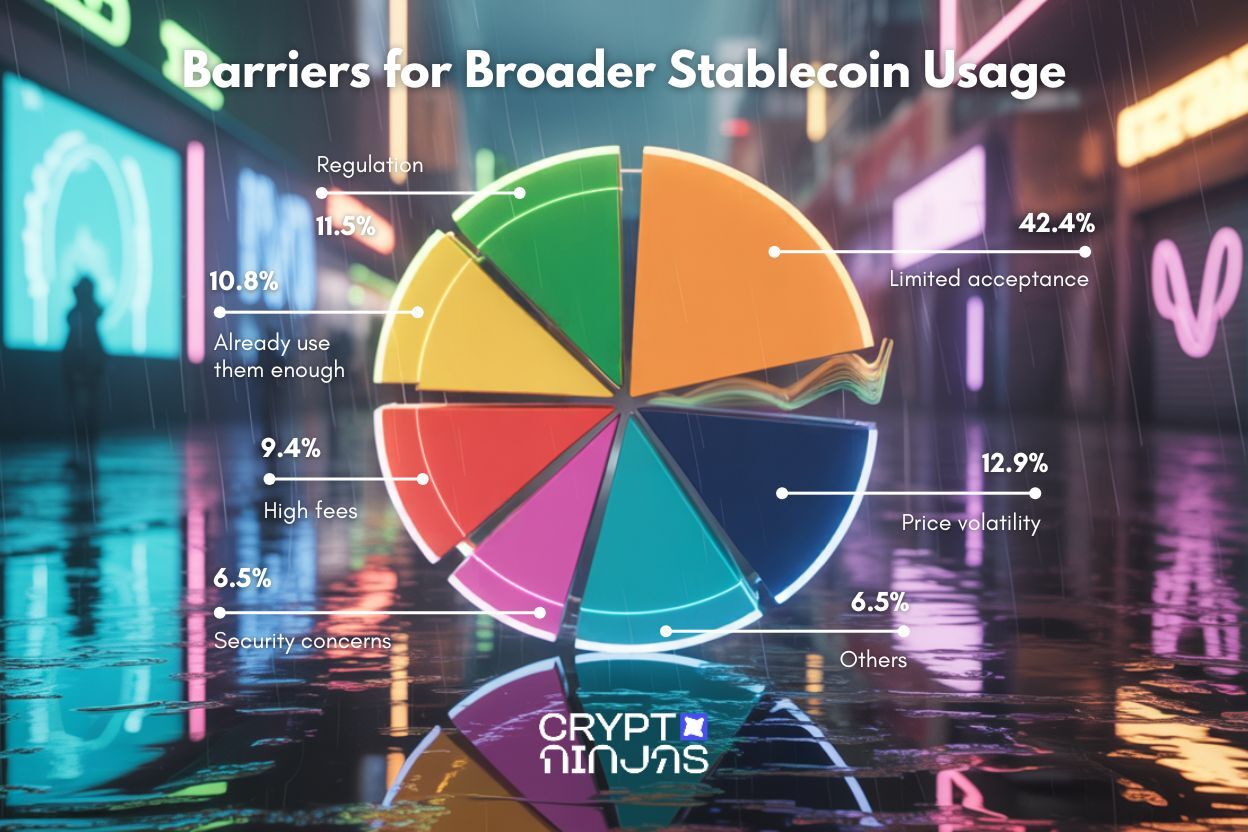

Biggest Buzzkill? You Can’t Use Them Everywhere

Despite all the hype, stablecoins still have a big fat Achilles’ heel: limited real-world acceptance. A full 43% of users said this was their main problem. Makes sense you can’t flex your crypto if no one’s accepting it at the checkout line.

Gen Z leads the complaint train on this, pointing out how annoying it is when their favorite financial tool isn’t usable in everyday life.

Millennials, on the other hand, are more worried about price swings. (Even “stable” coins have their moments.) And a big chunk of Gen X and Millennials (about 31%) admit they don’t even know how to start.

What Needs to Change? Education and Usability

Stablecoins won’t hit the mainstream until they stop feeling like a tech puzzle. Gen Z might thrive in crypto chaos, but older generations need:

- Easier onboarding: Skip the jargon. No brain-melting, just walk folks through the process of downloading a wallet, purchasing a coin, and using it.

- Cleaner design: Some cryptocurrency apps still have the appearance of 2003 spreadsheets.

- Plain English: Nobody wants to hear about “L2s” or “wrapped assets.” Just say what it does earn interest, send money fast, pay rent.

- More real-life uses: Let people use stablecoins for stuff they already do shopping, bills, saving. If it feels useful, people will use it.

Basically, stop overcomplicating it. Make stablecoins normal, and everyone else will catch up to Gen Z in no time.

The Bottom Line: Gen Z’s In, Everyone Else Is Watching the Trailer

Stablecoins aren’t just some crypto side quest they’re becoming a legit part of how young people manage money. Gen Z is leading the charge, not because they’re thrill-seekers, but because they see utility, speed, and opportunities that feel native to their digital-first lives.

If developers, platforms, and even your local coffee shop catch up, stablecoins might just be the next big shift in how all of us handle money.

Until then, Gen Z will be out here stacking coins calm, stable ones.

The post Study: Gen Z Is All In on Stablecoins While Boomers Hesitate appeared first on CryptoNinjas.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments