- REX Shares may launch a Dogecoin ETF using the 40 Act next week.

- While Dogecoin is up 116% in a year, it is still far below its December 2024 peak.

- The US SEC is reviewing 92 crypto ETF applications, with decisions due by October.

The prospect of a Dogecoin exchange-traded fund (ETF) debuting in the United States as early as next week has gained traction after Bloomberg ETF analyst Eric Balchunas pointed to fresh regulatory filings.

If confirmed, it would mark the first time the meme-inspired cryptocurrency receives such recognition in the US financial markets, signaling yet another milestone in the gradual institutional embrace of digital assets.

REX Shares may launch the first US Dogecoin ETF next week

According to Balchunas, ETF issuer REX Shares has filed an effective prospectus with the US Securities and Exchange Commission (SEC) under the Investment Company Act of 1940, commonly known as the 40 Act.

This alternative structure allows a faster path to market compared to the traditional ETF approval process that requires Form S-1 and 19b-4 filings.

The same approach was successfully used by REX earlier this year to roll out its Solana staking ETF.

Industry observers, including ETF Store president Nate Geraci, have described this strategy as a “regulatory end-around.”

REX Shares w/ the regulatory end-around…

Looks like two crypto ETF launches are imminent.

REX-Osprey ETH + Staking ETF and REX-Osprey SOL + Staking ETF.

'40 Act funds taxed as C-Corp (so double taxation).

Both ETFs seek to stake at least 50% of underlying crypto asset. https://t.co/4JyczUeSpG

— Nate Geraci (@NateGeraci) May 30, 2025

While it avoids some of the hurdles faced by spot crypto ETFs, it still provides investors with a regulated investment product tied to the price movements of the underlying asset.

REX’s move positions Dogecoin alongside Solana in breaking through regulatory bottlenecks that have delayed other crypto ETFs.

In its filing, REX highlighted the risks of exposure to Dogecoin, acknowledging its volatility and the unpredictability of its market behavior.

The company noted that the token is “subject to unique and substantial risks,” with price swings that can be rapid and severe.

Despite these warnings, Dogecoin’s cultural appeal and growing popularity continue to attract investor interest.

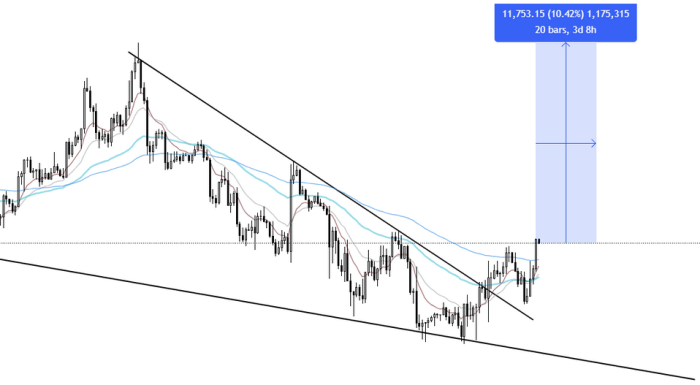

Over the past year, Dogecoin’s price has gained more than 116%, though it has cooled from its December 2024 peak of $0.4672.

At the time of writing, the token is trading near $0.2142, reflecting both its volatility and its resilience in the broader crypto market.

Elon Musk’s long-standing association with Dogecoin, from calling himself the “Dogefather” to joking about the token on national television, has only amplified its presence beyond crypto circles.

More recently, Musk’s attorney Alex Spiro has been linked to efforts to raise $200 million for a company focused on Dogecoin-related investments.

If REX proceeds with the launch, its fund would become the first US-listed ETF to provide direct exposure to Dogecoin,

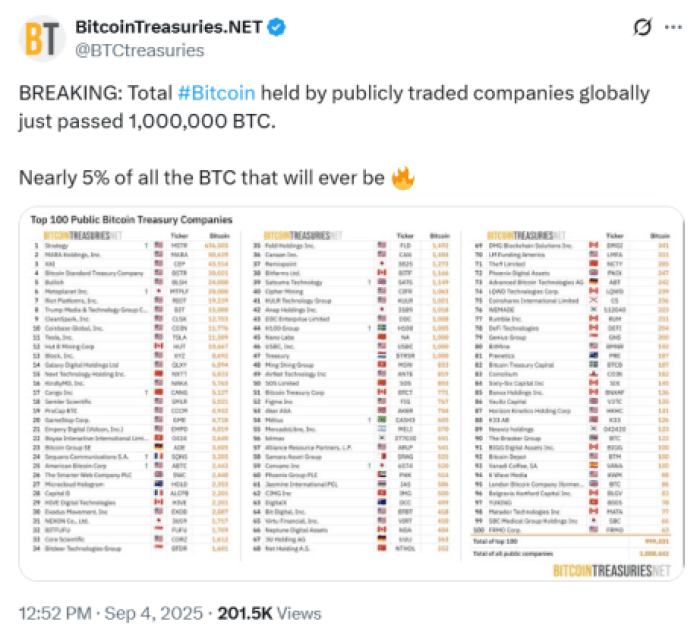

This would not only boost the memecoin’s legitimacy in the eyes of institutional investors but also signal a broader acceptance of alternative cryptocurrencies beyond Bitcoin (BTC) and Ethereum (ETH).

The US SEC is currently reviewing 92 crypto ETF applications

The potential launch of a Dogecoin ETF comes at a time when the SEC is facing a wave of crypto-related applications.

Bloomberg Intelligence analyst James Seyffart reported that the agency is currently reviewing 92 filings, a significant jump from just 72 in April.

NEW: Here is a list of all the filings and/or applications I'm tracking for Crypto ETPs here in the US. There are 92 line items in this spreadsheet. You will almost certainly have to squint and zoom to see but best I can do on here pic.twitter.com/lDhRGEQBoW

— James Seyffart (@JSeyff) August 28, 2025

Many of these proposals involve altcoins such as Solana, XRP, and Litecoin, which are expected to see final rulings by October.

This surge in applications highlights growing institutional appetite for diversified crypto investment products.

Digital asset funds have already recorded a strong rebound, with $2.48 billion flowing into such products last week alone.

In August, total inflows reached $4.37 billion, pushing the year-to-date figure to $35.5 billion. The momentum indicates that despite regulatory uncertainty, demand for crypto-linked financial instruments remains robust.

The outcome of these filings could reshape the crypto investment landscape in the United States.

If approved, a Dogecoin ETF would add to the expanding menu of regulated products, allowing investors to gain exposure to assets once dismissed as fringe or speculative.

At the same time, it would raise new questions about the risks and sustainability of meme-driven markets, especially as more altcoins seek entry into mainstream financial channels.

For now, all eyes are on the SEC and REX Shares. Should the filing proceed without delay, Dogecoin could soon have its first dedicated ETF on US markets, a milestone that would solidify its evolution from internet joke to a legitimate, tradable financial asset.

The post Bloomberg Analyst predicts the launch of the first Dogecoin ETF next week appeared first on CoinJournal.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments